A job in real estate investment trusts may be something you’ve considered. If so, you might be thinking about How Many Jobs are Available in Real Estate Investment Trusts ?

Indeed, there are 326,000 available jobs in the real estate investment trust. The number of jobs in the United States that are indirectly related is also close to 3.4 million. The demand has gradually grown in recent years and is anticipated to do so going forward.

We’ll find out some of the highest-paying real estate investing situations here. But first, let’s learn what REITs are, why they’re important, and how to invest in them.

What are Real Estate Investment Trusts [REIT]?

Real estate investment trusts (REITs) are trusts, corporations, or organisations that own, manage, and invest in real estate that generates income, such as office buildings, hotels, parks, and retail centres.

This type of security allows investors to pool their resources and purchase real estate assets that are professionally managed. It has some similarities to passive real estate investing.

By making investments in REITs, you can generate income and build long-term wealth.The value of the REIT shares, which can be sold publicly or privately on significant exchanges, together with the increase in the value of the underlying real estate assets.

How Does It Work?

Congress approved the Real Estate Investment Trust Act in 1960.The idea was to give everyone the chance to make money by investing in real estate that generates an income. An investment in a REIT is comparable to one in a different sector of the economy.

In order to buy real estate investments, which they later either rent out or sell, a REIT pools capital from both public and private investors.The Unit Holders of this Scheme will make money from renting and selling a section of the Property without even owning or managing the Property themselves.

REITs can own a huge range of assets, including but not limited to

- Self-storage facilities.

- Buildings for offices.

- Hotels.

- Medical facilities.

- Malls

- Apartment buildings are examples of retail centers

According to the Internal Revenue Code, 75% of a corporation’s revenue comes from real estate sales, real estate interests, or real estate rents. The corporation’s overall revenue should be around 95% passive, and its total assets should be roughly 75% real estate.

Types of REIT Funds

Although some REITs may invest in a range of real estate assets, the majority focus on a specific property type or region. REITs can be categorised into many groups based on their ownership structure, the kind of properties they own or finance, or how they generate revenue. Equity and mortgage REITs are the two most prevalent types of REITs.

Equity REITs:

An assortment of real estate investment trusts (REITs) that hold and manage rental properties like office buildings, shopping malls, residences, and warehouses that generate income. Equity REITs, which are traded on prominent stock exchanges, make up the bulk of REITs.

Rent and property sales are how they earn money. Equity REITs are enticing investments for those looking for a steady stream of income because of their substantial dividend payouts and potential for capital growth.

residential REITs ,Office REITs, retail REITs, and industrial REITs are the subcategories under which equity REITs are categorised.

Hotel and Resorts

Companies that specialise in the acquisition, development, ownership, leasing, and management of hotel and resort properties are included in this subcategory. The economy’s growth sharply accelerates the overgrowth of these enterprises.

Health Care

Health care REITs comprise nursing homes, hospitals, and assisted living facilities. Changes in public policy can have a big impact on the healthcare sector, which makes them particularly unpredictable.Examples are National Health Investors Inc. and CareTrust REIT (CTRE) (NHI).

Industrial

Industrial real estate investment trusts (REITs) are businesses that are involved in the acquisition, leasing, ownership, development, and management of industrial structures such industrial warehouses and distribution centres. The main advantages of industrial REITs include long-term lease terms, the prevalence of net leases, and rising e-commerce demand where the tenant covers the operational costs.

Office

Office REITs are businesses that invest in office buildings. Tenants that have signed long-term leases pay their rent to them. It is substantially less profitable to invest in a top company in a city with little to no growth than it is in one with rapid growth.

Residential

These real estate investment trusts (REITs) operate and oversee multi-family rental apartment complexes and communities of pre-constructed homes. One should consider specific market ups and downs before investing in this sort of REIT.

Retail

Rent payments from tenants are how retail REIT makes its money. Therefore, a retail REIT would not make any money or profit if the tenants default on their rent payments for any reason. Therefore, before making an investment in a retail estate endeavour, it is essential to properly study the retail industry.

Diversified

An equity REIT must operate in at least two different property kinds, such as residential and commercial, in order to be deemed diversified. The category’s clear advantage is the possibility of diversifying one’s interests across several real estate asset classes. W.P. and Vornado Realty Trust are two examples.Carey (WPC) (VNO).

Mortgage REITs

Mortgage REITs, also known as mREITs, concentrate their investments in mortgage-backed securities (MBS), which are securities that reflect a claim on the cash flows from a pool of mortgages.

The profitability of mortgage REITs is significantly influenced by net margin interest, which is the difference between the income they get from mortgage loans and the cost of funding these loans.They might be more susceptible to interest rate increases as a result of this paradigm.

Consider the scenario where company ABC, a REIT, lends money to a developer of real estate. Interest on loans is how company ABC makes money. Company ABC is a mortgage REIT as a result.

Periodic payments that resemble bond coupon payments are made to MBS investors. It can be a good investment for income-seeking investors who routinely pay high dividend rates. Investors should be aware of the risks associated with Mortgage REITS, including interest rate and credit risk.

Agency mREITs and Non-Agency mREITs are additional subcategories of mREITs.

· Agency mREITS

Investments by Agency REITs are made in MBS, which are guaranteed by GSEs including Fannie Mae, Freddie Mac, and Ginnie Mae. By ensuring the principal repayment of the mortgages in the pools that underlie the securities, the agencies give the securities a high level of credit safety. However, the MBS agency could take a while, particularly when consumers prepay or restructure their mortgages.

· Non-Agency mREITS

Non-Agency REITs engage in MBS and are backed by real estate loans that are not insured by the government. Instead, sponsorship is often supplied without support from the government by private businesses. Jumbo home loans or commercial mortgages that are unsuitable for agency underwriting may be found in these pools.

Hybrid REITs

Real estate investment trusts known as hybrid REITs combine equity and mortgage components.Equity REITs own real estate, whereas mortgage REITs invest in mortgage loans or mortgage-backed securities.Hybrid REITs aim to get the advantages of both with less risk than if they were only investing in one investment type.

Are REITs a Good Investment?

There are more than 145 million investors in REITs, and they might be a sensible choice for a number of reasons. If investors wish to diversify their portfolio without significantly raising risk, they can consider investing in a REIT.

Because REITs do not pay corporate taxes, you benefit tax-wise.

Many REITs offer dividend yields above 5%, whilst the majority of stocks have yields of less than 2%. As a result, anyone seeking more chances to reinvest or increase their income should think about buying a REIT.

Benefits of REITs

REITs are a great investment due to the many benefits they offer. Some of the most obvious benefits of acquiring REITs include the following:

Transparency

REITs are extremely transparent and are subject to SEC regulations. Therefore, it provides an extra measure of security to ensure that the management does not waste the investors’ money.

Diversification

A REIT is a new asset class that you can use to diversify your portfolio. You can broaden your exposure to several types of real estate, including office buildings, shopping centres, apartments, warehouses, and more by diversifying your holdings. Earnings can rise while risk is reduced.

High-Profits

REITs have the potential to deliver significant returns because they are mandated to release at least 90% of their taxable revenue as dividends to shareholders. It suggests that they can grow faster than other types of investments by regularly being able to reinvest their profits.

Ideal for Small Investors

Small real estate investors can now contribute to commercial real estate portfolios thanks to RITs. The money could be used to build a hotel, office building, shopping centre, etc. One benefit that may make REITs ideal for small investors is the absence of a significant down payment requirement.

- Investors don’t need a mortgage to make a small investment in a variety of real estate holdings; they can do so for as little as $20.

- Investing in a REIT entails less risk than buying real estate outright.

- A few clicks will let you purchase an ETF or a REIT stock (Assuming you already have a brokerage account).

- Earn monthly gains that are assured almost always.

Real Estate Industry Job Statistics

REITS are in high demand, and employment opportunities in the real estate industry are plentiful.

The US Department of Labor reports that salespeople, real estate brokers, and property managers are in increased demand. In 2022, the real estate sector will employ thousands of individuals nationwide, with an average income of $51,220 per year.

Average real estate broker salaries are much lower than those in the REIT industry. As of October 2022, the average Real Estate Investment Trust (REIT) analyst earned $108,164 year, which is twice what real estate brokers and salespeople make. However, the usual compensation range is between $76,495 to $145,071.

Real estate investment trusts are thought to indirectly provide 2.6 million full-time jobs.

The Bureau of Labor Statistics predicts that over the next few years, employment in the real estate sector will rise. So if you’re looking for a stable job with strong prospects and a good salary, a career in REITS is a perfect alternative.

Market cap is also known as market capitalization. This phrase refers to the market value of the outstanding shares of a publicly traded stock while discussing investing. A company’s market capitalization may also be used to represent its value.

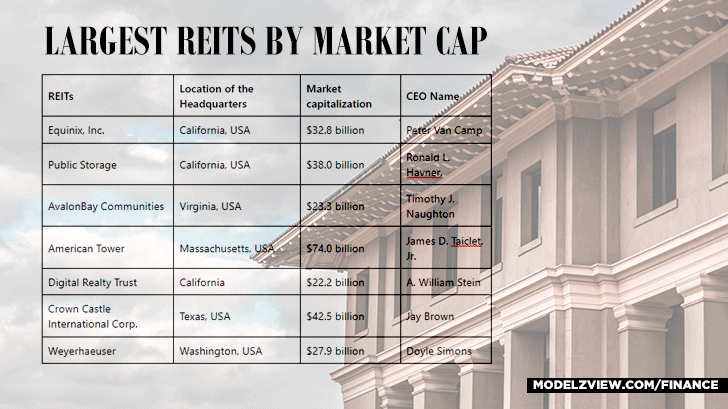

Largest REITS by Market Cap

Market cap is also known as market capitalization. This phrase refers to the market value of the outstanding shares of a publicly traded stock while discussing investing. A company’s market capitalization may also be used to represent its value.

Here are the largest REITs by market capitalization:

| REITs | Location of the Headquarters | Market capitalization | CEO Name |

| Equinix, Inc. | California, USA | $32.8 billion | Peter Van Camp |

| Public Storage | California, USA | $38.0 billion | Ronald L. Havner, |

| AvalonBay Communities | Virginia, USA | $23.3 billion | Timothy J. Naughton |

| American Tower | Massachusetts, USA | $74.0 billion | James D. Taiclet, Jr. |

| Digital Realty Trust | California | $22.2 billion | A. William Stein |

| Crown Castle International Corp. | Texas, USA | $42.5 billion | Jay Brown |

| Weyerhaeuser | Washington, USA | $27.9 billion | Doyle Simons |

Types of Jobs in REITS

Do you want to start a career in the REITs industry? This industry offers a variety of jobs, from entry-level positions to more senior positions. Here is a list of a few of them:

Real Estate Attorney

Real estate attorneys provide legal assistance to individuals and organisations involved in transactions involving the acquisition, resale, development, or use of real property. Real estate attorneys perform due diligence, stand in for clients in court, create and analyse legal documents, and advise clients on legal compliance.

The post requires a bachelor’s degree in law or a profession related to real estate. Making between $119,000 and $125,000 year is straightforward.

REIT Analysts Jobs

A REIT analyst’s primary responsibilities would be to do research on REITs and provide investors with suggestions. To succeed in this role, you must be well-versed in the REIT sector and the factors affecting REIT performance. Additionally, you must be able to effectively communicate your findings to investors and the management teams of REITs.

A REIT analyst needs a bachelor’s degree in economics, real estate, or finance. Skills in organisation, research, and analysis are crucial. Although it varies depending on your state, amount of experience, talents, and many other factors, the average salary is $90,885 per year.

Real Estate Investor

Real estate investors assist people in achieving financial independence by making real estate investments. Investors frequently employ fix-and-flip, buy-and-hold, wholesaling, and rehabbing strategies to boost their investment’s return.

A real estate investor can earn up to $124,000 per year. An accounting, business, or finance bachelor’s degree is required to work as a real estate investor. The person should also be skilled in management and communication strategies. Real estate is a lucrative industry for those who are interested in buying and selling it.

Real Estate Property Appraiser

The task of estimating a piece’s value falls under the purview of a real estate appraiser. To provide an accurate estimate, appraisers must have in-depth market knowledge.

The candidate for this role must hold additional real estate skills in addition to being qualified in appraiser training. Real estate property appraisers have a salary range of $35,000 to $200,000. They must also have great data analysis and comparison skills, as well as exceptional listening abilities, and they must be skilled at communicating with clients.

Leasing Consultant

The duties of the leasing consultant include generating new leads, visiting clients, and drafting lease agreements. The real estate industry is represented by the leasing specialist. They assist customers in making purchases by assisting them in selecting homes and properties that fit their needs and budget.

In addition to having a thorough understanding of the real estate industry, candidates for this role should have outstanding promotion and advertising skills. The typical annual wage for a leasing consultant varies depending on the company and level of employment. A bachelor’s degree in property management or a closely related field is required for this role.

Real Estate Sales Supervisor

Real estate sales supervisors are in charge of a team, provide training and support to agents, help their businesses grow, and give performance reviews. They are in charge of managing the business unit’s daily activities, which include hiring and firing employees, selling goods, renting out equipment and maintaining it, renting out daily lockers, and providing visitor service trails.

One must be enthusiastic about managing a team, attracting new clients, compiling and organising sales data, and taking on demanding responsibilities in order to be considered for this leadership job. It is necessary to have a bachelor’s degree in business, marketing, finance, or accounting. A real estate sales supervisor earns an annual salary of $44,321.

Investor Relationship Roles

The role of investor relations is relationship management. They frequently require working with a team of experts to establish and carry out communication plans for investors, analysts, and the financial community. The annual meeting and any associated documents, such as the proxy statement and annual report, will be planned by the investor relations department. They must also adhere to all SEC rules as well.

To be considered for this position, the applicant must hold a bachelor’s degree in finance and accounting. He needs to be an excellent presenter and have strong English skills. A competitive individual should be capable of managing investor relations (IR) programmes and performing financial tool analysis. The average yearly salary is $104,509.

Asset Management Roles

It is one of the highest paying positions in the real estate investment trusts industry. The asset manager of a REIT supervises day-to-day activities while working to protect and raise the value of the portfolio. It can require negotiating leases or overseeing upgrades and repairs.

It comprises developing and implementing business plans, monitoring performance, and controlling capital expenditures. Asset managers need to work well with development, accounting, finance, and acquisitions in order to perform their tasks.

In addition, they are in responsible of overseeing the acquisition, financing, capital expenditures, leasing, and disposal of every component of a REIT’s portfolio. Asset managers can make up to $200,000 a year.

Property Management Roles

Property managers who are also in charge of marketing, lease enforcement, maintenance and repair, and rent collection are in charge of the REIT’s properties. There aren’t any requirements to work as a property manager.

The most qualified applicants are adaptable and have great project management abilities. The REIT company determines the property manager’s pay, which ranges from $47,657 to $65,989.

Acquisition Roles

Finding and evaluating possible acquisition targets, creating and negotiating contracts, and organising due diligence procedures are all the responsibility of the acquirer.

These careers in real estate investing also pay well, at $80,000 annually. Anyone with experience in business, marketing, finance, or capital markets is eligible for this position. Success in an acquisition role requires strong analytical skills, real estate sector knowledge, the ability to use creativity to solve problems, and the capability to provide new investment options.

Development Roles

Development managers provide recommendations on the most profitable methods to use available space while supervising the development of new buildings or modifications. Development positions are essential in a REIT since they guarantee that the company’s buildings are well-maintained and generate money.

They also have work related to financial development. Development positions in the REIT sector are in high demand because to their high compensation, challenging nature, and high regard. Their yearly pay is between $62,950 and $83,091. For this occupation, you need a bachelor’s degree in real estate and finance. Good analytical skills are necessary.

Current Available Jobs in the REIT Industry

There are several job options for those with a strong interest in finance and real estate trade. These well-paying jobs provide you the chance to have the life you’ve always wanted. The table below contains further information about some of these affluent jobs, including their pay.

| Job Title | Income |

| Financial Analyst | $80,000 per year |

| Accounting Manager | $90,000 per year |

| Construction Supervisor | $89,000 per year |

| Property Manager | $90,000 per year |

| Director of Acquisition | $125,000 per year |

| Real Estate Agent | $100,000 per year |

| Director of Real Estate and Facilities | $130,000 per year |

FAQs

What is the Average Return on a REIT?

The average return on a REIT, or real estate investment trust, might vary depending on the particular trust and the situation of the economy as a whole. Investors typically use the FTSE NAREIT Equity REIT Index to determine the state of the US real estate market.

In June 2022, the 10-year index had an average yearly return of 8.34%. The index’s 25-year return is 9.05%, while the S&P 500’s and the Russell 2000’s are 7.97% and 7.41%, respectively. However, REITs frequently provide investors higher returns compared to conventional investments like bonds or stocks. It’s because REITs are legally required to distribute the bulk of their profits to owners, which ensures a consistent stream of income.

What are the Disadvantages of REITs?

REITs can be a good investment for those looking for income and diversity, but it’s important to understand the cons before investing. Some of its minor issues are as follows:

• Market risk

• Like other types of income, dividends are taxed at the same rate.

• The possibility of hefty transaction and management fees

• Modest growth

How many Industrial REITs are there?

Industrial REITs are a relatively uncommon type of REIT, despite there being many other varieties. There are only 13 industrial REITs, according to reports. The three biggest industrial REITs are Rexford Industrial Realty, Prologis, and Duke Realty Corporation, with market capitalizations of $10.3 billion, $88.8 billion, and $19.5 billion, respectively.

Where is the Most Money in Real Estate?

This will depend on your investment goals and objectives. If you’re looking for high current income, mortgage REITs can be a good option. Mortgage REITs are more profitable than Equity REITs when interest rates are rising. Whatever your goals may be, REITs can help you reach them while also providing you with a number of important advantages that other investment options might not.

Conclusion

REITs are one of the growing future sectors. Because of its expansion, there are additional employment options. While some professions require a bachelor’s degree, others require specialised training.

A person may earn more than six figures depending on their educational background and level of productivity. There are many different professions, so you’re likely to discover one that complements your interests and abilities. As a result, get started on your career in the REITs industry straight away.

GIPHY App Key not set. Please check settings